- India

- International

49% Insurance FDI: 6 months later foreign firms still elusive

Experts say that while a delay in issuing final guidelines on the foreign investment cap hike in the insurance sector is hampering investments and growth within the industry, it will affect the ability of companies to offer a better and wider range of products at competitive prices.

In December 2014, three months before the Insurance Act was amended by Parliament, finance minister Arun Jaitley had said hiking of the foreign investment cap in the insurance sector to 49 per cent, which has been pending since 2008, will result in a capital inflow of $6-8 billion.

While six months have passed since then, not a single foreign reinsurer has entered India and not a single foreign insurance giant has hiked stake in an Indian entity from 26 per cent to 49 per cent.

Since the regulator Insurance Regulatory and Development Authority (IRDA), has not brought out the regulations, experts and industry insiders feel that while a delay in issuing final guidelines is hampering investments and growth within the industry, it will affect the ability of companies to offer a better and wider range of products at competitive prices.

“A hike in foreign direct investment would result into better options for customers to choose from a wide range of insurance products at competitive prices,” said the chief executive officer of a general insurance company. The three-month period of March-May this year witnessed just $184.97 million (about Rs 1,186 crore) foreign direct investment in the insurance sector, commerce minister Nirmala Sitharaman had told Parliament.

“A hike in foreign direct investment would result into better options for customers to choose from a wide range of insurance products at competitive prices,” said the chief executive officer of a general insurance company. The three-month period of March-May this year witnessed just $184.97 million (about Rs 1,186 crore) foreign direct investment in the insurance sector, commerce minister Nirmala Sitharaman had told Parliament.

[related-post]

The initial brouhaha over the insurance foreign direct investment seems to have vanished and nobody talks about bringing billions of dollars into the Indian insurance segment these days. Although Insurance Regulatory and Development Authority chairman TS Vijayan had recently said at least six insurance companies have expressed interest in raising their stake in their foreign partners from 26 per cent currently to 49 per cent, the government is yet to receive any formal proposal from global giants to raise their stake in the Indian joint ventures in the last six months.

Insurance Regulatory and Development Authority is yet to bring out regulations — over 40 of them — to align the new Act with the market and regulatory requirements. Lloyds has been waiting for quite some time for the regulatory framework. “Foreign reinsurers are also not waiting. Many of them have already indicated that they are not going to set up base in the much-touted GIFT City in Ahmedabad as it doesn’t make sense anymore,” said the chief executive of an insurance company.

The Insurance Laws Amendment Act, 2015, was passed in March 2015, bringing out key amendments like enhancing foreign direct investment to 49 per cent, permitting foreign reinsurers and Lloyds of London to establish reinsurance branches in India and recognising health insurers as a separate class different from general insurers, among others. “These changes in laws require corresponding operative changes in regulation. Though more than six months have passed since the law was amended, regulatory changes to implement the changes in the law have not been notified. The delay seems abnormal,” said former Insurance Regulatory and Development Authority member KK Srinivasan.

However, some of the changes like how to permit foreign reinsurance branches to operate do seem complicated. “Particularly how to enable Lloyds to form reinsurance branch is not easy. Lloyds Corporation is not the risk taker. It is the Members and Syndicates of Members who are the risk takers. How to permit and how many members or how many syndicates to permit could be issues. Then again many of the global reinsurers themselves seem to hold Lloyds memberships. They will not come in as branches of foreign reinsurers if there are regulatory arbitrages in favour of Lloyds branches and vice versa,” Srinivasan said.

Two major issues which are vexing the sector are: Valuation (pricing) while hiking the foreign direct investment and management control. “We need to follow Indian regulations on valuation and management control. Insurance Act states that management control has to be with the Indian partner. This means Indian partner will have majority on the board,” Bajaj group chief Rahul Bajaj said.

In fact, some of the insurance joint ventures are stuck in the valuation aspect.

The foreign partners of some of the joint ventures want to hike the stake at predetermined prices — mostly at a very low price — they agreed when they signed the joint venture agreement. Some Indian and foreign partners of life and non-life ventures have been involved in a tug-of-war over “fair and reasonable” pricing and valuation for hiking the stake but the subsequent Reserve Bank of India (RBI) norms make it clear that it should be at a fair price.

“Where the shares of an Indian company are not listed on a recognised stock exchange in India, the transfer of shares shall be at a price not less than the fair value worked out as per any internationally accepted pricing methodology for valuation of shares on arm’s length basis which should be duly certified by a chartered accountant or a Sebi-registered merchant banker,” says the RBI circular on transfer of shares involving foreign direct investment. Insurance penetration, new products and innovations seem to be the casualty due to these delays.

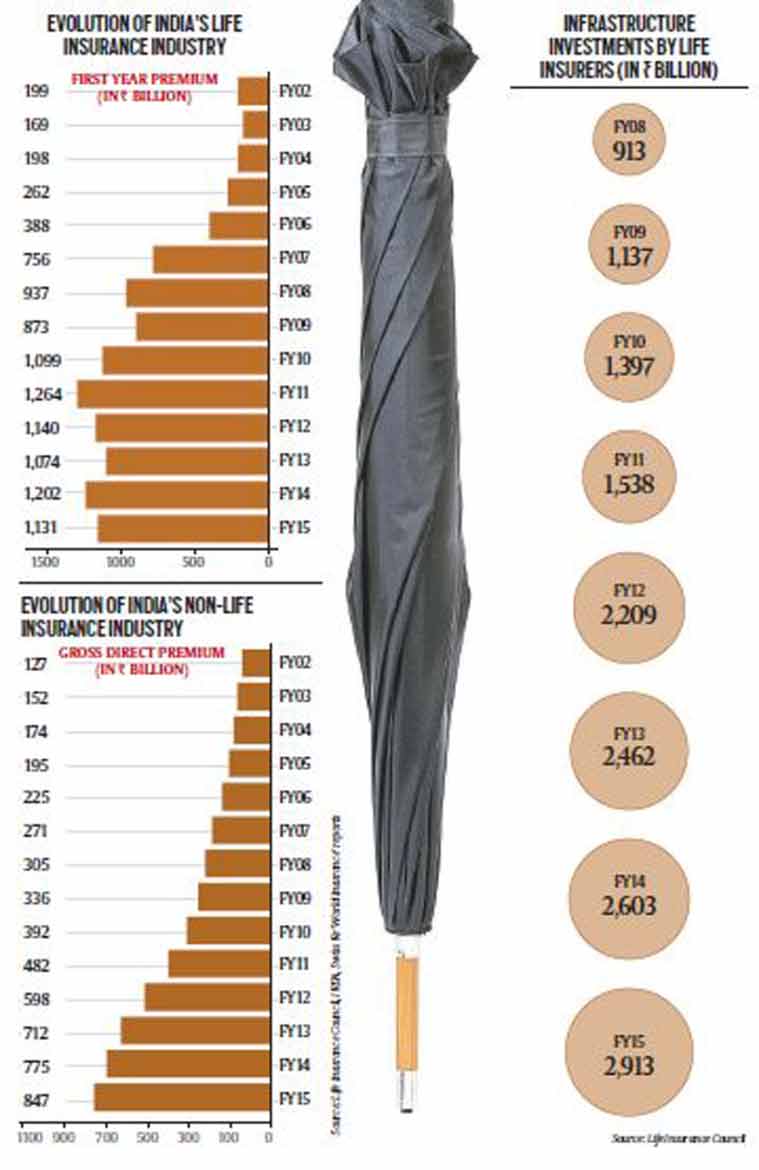

According to a Confederation of Indian Industry -EY study, a strong growth run during 2005-11 had taken India’s life insurance penetration (FY10: 4.6 per cent) beyond the global average (FY10: 4 per cent). However, stagnation in life premium collections since 2011 against a high nominal rate (real + inflation) of GDP growth led to a drop in the penetration level from 4.6 per cent in FY10 to 2.6 per cent in FY15 (FY15 global average: 3.4 per cent), a level not seen since 2006.

Similarly, India’s life insurance density (premium per capita in dollar), which continues to be much lower than the global average (FY15: $368), fell from a high of $56 in 2011 to $44 in FY15.

Despite the low rate of adoption, India’s life insurance market is the 11th largest in terms of gross written premiums.

May 17: Latest News

- 01

- 02

- 03

- 04

- 05