- India

- International

FIIs exit, retail MF inflow on the rise

Over the first five months of this year, FIIs have invested Rs 38,335 crore or over $6 billion despite the stock markets remaining under pressure.

The Fed also reduced its US growth and federal funds rate forecasts after its policy meeting on Wednesday. Following the decision both Asian and European markets traded weak.

The Fed also reduced its US growth and federal funds rate forecasts after its policy meeting on Wednesday. Following the decision both Asian and European markets traded weak.

Even as global markets fell after the US Federal Reserve announced to defer the rate hike decision, Indian markets witnessed a relief rally and the Sensex at the Bombay Stock Exchange rose 283 points or 1.1 per cent to close at 27,115.

The Fed also reduced its US growth and federal funds rate forecasts after its policy meeting on Wednesday. Following the decision both Asian and European markets traded weak.

[related-post]

In anticipation of rate hike in the US and decline in global growth rates, emerging economies had been witnessing outflow of foreign institutional investor (FII) funds from their markets. India too had its share and for the first time in 21 months, the FIIs emerged as net sellers in May 2015 as they pulled out an aggregate of Rs 15,696 crore from debt and equities.

However, even as the FIIs stayed away from Indian equities over the last couple of months since the government started sending out minimum alternate tax (MAT) notices to them and concerns started growing over India’s growth and US rate hike, it has been the domestic investors who provided support to the markets.

The support has come especially from the mutual fund industry that has been investing heavily in the markets, thanks to the strong inflow of investor money into equity schemes of mutual funds. Over the last 12 trading sessions while the FIIs have pulled out a net of Rs 4,610 crore from Indian equities the domestic institutional investors (DIIs) have invested a net of Rs 6,985 crore in that period.

The support has come especially from the mutual fund industry that has been investing heavily in the markets, thanks to the strong inflow of investor money into equity schemes of mutual funds. Over the last 12 trading sessions while the FIIs have pulled out a net of Rs 4,610 crore from Indian equities the domestic institutional investors (DIIs) have invested a net of Rs 6,985 crore in that period.

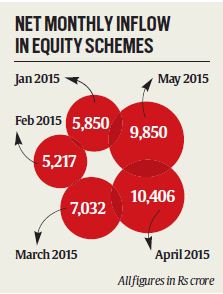

This is primarily a result of the continuing strong domestic fund flow into equity mutual funds. While the net inflow into equity MFs amounted to Rs 68,121 crore in 2014-15, the inflows have further strengthened in the first two month of the current fiscal. In April 2015 the net inflow into equity schemes amounted to Rs 10,406 crore and in May it stood at Rs 9,850 crore taking the aggregate of two months to Rs 20,256 crore.

Over the first five months of this year, FIIs have invested Rs 38,335 crore or over $6 billion despite the stock markets remaining under pressure.

Best of Express

May 20: Latest News

- 01

- 02

- 03

- 04

- 05