- India

- International

Bad loans by public sector banks soar 27 pc in a year

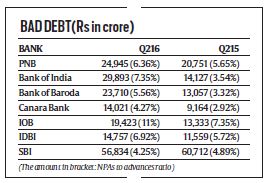

The banks with a major share in bad loans include Bank of India, Bank of Baroda, Indian Overseas Bank, SBI and Punjab National Bank.

Already burdened by bad loans, 37 banks, led by public sector ones, have reported a 26.8 per cent rise in non-performing assets (NPAs) over the 12-month period ending September this year.

This is a nearly 10 per cent rise from the 16.9 per cent growth in bad loans over the same period a year ago, with several projects, especially those in the infrastructure sector, stuck.

While the overall NPAs now amount to Rs 3,36,685 crore, the rise in the last 12 months ended September 2015 was Rs 71,000 crore, according to figures compiled by credit rating CARE.

The banks with a major share in bad loans include Bank of India, Bank of Baroda, Indian Overseas Bank, SBI and Punjab National Bank.

[related-post]

The figures show a continuous acceleration in the growth of NPAs, from 4 per cent in the second quarter of FY2014 to 4.2 per cent in Q2 of FY2015 and 4.9 per cent in the second quarter of FY2016.

At the same time, in the second quarter of FY16, net profits of banks also declined, by 1.5 per cent, compared to the positive growth rate of 29.5 per cent in the same period last year. The net profit margin came down to 7.7 per cent from 8.3 per cent during this period.

Among the big banks, the bad loans of Bank of India soared from Rs 14,127 crore to Rs 29,893 crore, of Bank of Baroda from Rs 13,057 crore to Rs 23,710 crore, and of Indian Overseas Bank from Rs 13,333 crore to Rs 19,423 crore.

The silver lining is SBI, India’s largest bank, whose asset quality improved, with gross NPAs as a percentage of gross advances falling 74 bps to 4.15 per cent (Rs 56,834 crore) from 4.89 per cent (Rs 60,712 crore).

The silver lining is SBI, India’s largest bank, whose asset quality improved, with gross NPAs as a percentage of gross advances falling 74 bps to 4.15 per cent (Rs 56,834 crore) from 4.89 per cent (Rs 60,712 crore).

Finance Minister Arun Jaitley, who met heads of PSU banks for a performance review on Monday, attributed the problem of NPAs to “pressures of the past”, and said, “The situation is going to improve… the series of steps which the RBI has announced will certainly improve the quality of assets.”

A senior Indian Overseas Bank official said they would use whatever ammunition the RBI has given to banks to recover bad assets, including strategic debt restructuring (SDR) and naming ‘wilful defaulters’.

On Monday, banks initiated steps to convert their loans into equity in a bid to recover over Rs 13,000 crore stuck in construction firm Gammon India, through the SDR route. Last week, SBI had declared Kingfisher Airlines and its promoter Vijay Mallya wilful defaulters, which means they won’t get further bank funds and stringent recovery measures will be initiated against them.

Banks have also implemented flexible debt restructuring under the 5/25 refinancing scheme, which involves big infrastructure projects getting more leeway in debt repayment and interest sops.

Credit Suisse, which analysed the leverage position of top 10 business groups with a combined debt of Rs 7,33,545 crore, found multiple instances of default over the past year. In case of four of the business groups, 40-65 per cent of their debt has already been downgraded to default (D rating) by rating agencies. There have been instances of visible default and cases of some banks classifying loans as NPAs to well-known corporates.

Khushroo Panthaky, partner, Walker Chandiok & Co, pointed out that NPAs in public-sector banks were higher than in the case of private-sector banks. “On an average, the NPAs here are 10-15 per cent higher. One of the reasons is the inherent weaknesses in their process of disbursement of loans and advances. Credit appraisal of customers is also something these banks need to improve on.”

At the same time, Panthaky said, “Higher instances of NPAs in public-sector banks are attributable to the fact that these banks have significant exposures to sectors such as steel, aviation, mining, infrastructure, real estate etc.”

Rating firm ICRA has, in fact, called for “policy interventions by the government… to reduce stress on iron & steel, power and sugar sectors”, to improve the situation.

RBI Deputy Governor R Gandhi said that despite proper credit appraisal and proper structuring of loans, slippages in asset quality were sometimes inevitable when economic cycles worsen.

As many as 299 mega projects involving an outlay of Rs 18.13 lakh crore were stalled with the Project Management Group till March 2015.

The RBI also sees inadequacies in the credit appraisal capacity of banks, more specifically on project appraisal, as a fundamental issue. Most banks have just one technical consultancy firm, besides some specific desks performing this task. Smaller banks simply follow the decisions taken by big banks while extending loans. Bankers have complained that the same consulting firm that drafts a project report then conducts the forensic audit as well as comes back to banks for restructuring loans.

RBI Governor Raghuram Rajan also commented on this last month. “Ironically, the same consultants who advised on project initiation are also called in when the project goes bad. Banks need to have these skills in-house so they are not forced to follow the herd,” he said.

Another factor behind more NPAs, say bankers, is the RBI move to withdraw special asset classification benefits available to corporate debt restructuring with effect from April 1, 2015. Subsequent to that, there has been a sudden drop in assets being ‘restructured’, with banks becoming very choosy about restructuring loans to borrowers who are under stress.

Must Read

May 19: Latest News

- 01

- 02

- 03

- 04

- 05